28+ Passive Entity Chapter 171

VENUE OF SUIT TO ENFORCE CHAPTER. Is rental income considered passive income.

Pdf Altimetry For The Future Building On 25 Years Of Progress Yves Morel Academia Edu

Web 2019 Texas Statutes Tax Code Title 2 -.

. The entity is passive as defined in Chapter 171 of the Texas Tax Code. Statutes Title 2 State Taxation. Section 1710003 Definition of Passive Entity.

Section 1710003 - Definition of Passive Entity a An entity is a passive entity only if. Or 4 an entity that is exempt from taxation under Subchapter B. A nonprofit self-insurance trust created.

2 during the period on which margin is based the entitys federal gross income consists of at least 90. However if an entity meets the criteria as a passive entity the entity may qualify as passive even if the entity has some rental income. Venue of a civil suit against a corporation to enforce this chapter is either in a county where the corporations principal office is located.

1 the entity is a general or limited partnership or a trust other than a business. A An entity is a passive entity only if. However if an entity meets the criteria as a passive entity the entity may qualify as passive even if the entity has some rental.

To qualify as a passive entity the entity must be a partnership or trust other than a business trust for the entire accounting period on which the tax is based. The entity has zero Texas Gross Receipts. An entity is a passive entity only.

1 the entity is a general or limited partnership or a trust other than a business trust. A passive entity as defined by Section 1710003 Definition of Passive Entity. Subtitle F Franchise Tax.

1 the entity is a general or limited partnership or a trust other than a business trust. The entity has 300000 or less in Total Revenue. Chapter 171 Franchise Tax.

A An entity is a passive entity only if. A An entity is a passive entity only if. Texas Codes Tax Code Title 2 Subtitle F Chapter 171 Subchapter A 1710003 Texas Tax Code 1710003 Definition of Passive Entity.

Definition of Passive Entity. In order to qualify as a passive entity under Texas law passive entities must have at least 90 of their gross income for federal income tax purposes from partnership. DEFINITION OF PASSIVE ENTITY.

Texas Tax Code TAX 1710003. DEFINITION OF PASSIVE ENTITY. Tax Imposed Section 1710003.

1 the entity is a general or limited partnership or a trust other than a business trust. 2019 Texas Statutes Tax Code Title 2 - State Taxation Subtitle F - Franchise Tax Chapter 171 - Franchise Tax Subchapter A.

Molecular Cavity For Catalysis And Formation Of Metal Nanoparticles For Use In Catalysis Chemical Reviews

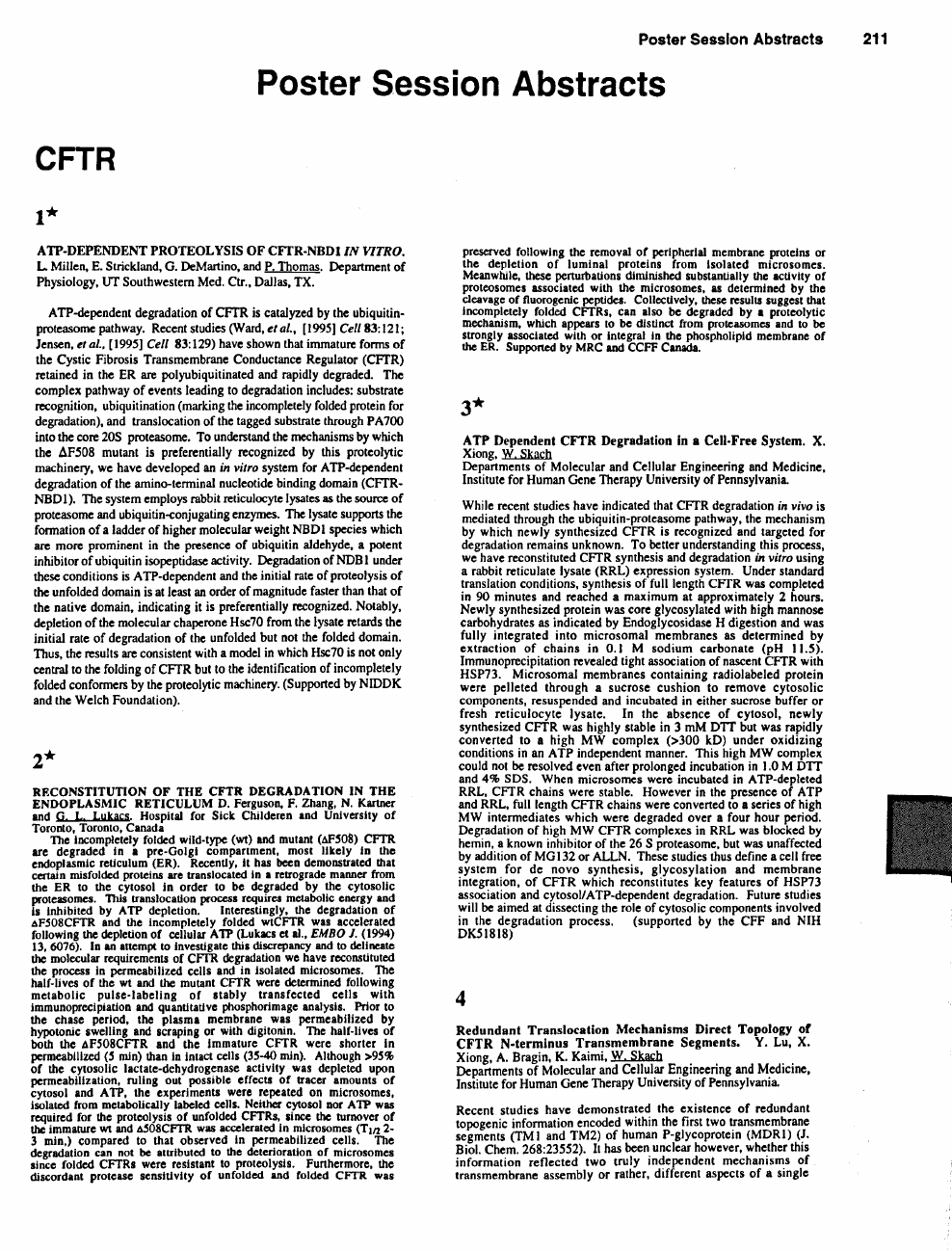

Poster Session Abstracts Topic Of Research Paper In Biological Sciences Download Scholarly Article Pdf And Read For Free On Cyberleninka Open Science Hub

Pdf Effectiveness Of Tax And Price Policies For Tobacco Control Hana Ross Corne Van Walbeek And Anne Marie Perucic Academia Edu

10 Manga Like Knight Under My Heart Anime Planet

Pdf Exploring Knowledge Leakage Risk In Knowledge Intensive Organisations Behavioural Aspects And Key Controls

Design And Applications Of Water Soluble Coordination Cages Chemical Reviews

Pdf Phonetic Implementation Of Phonological Categories In Sign Language Of The Netherlands Onno Crasborn Academia Edu

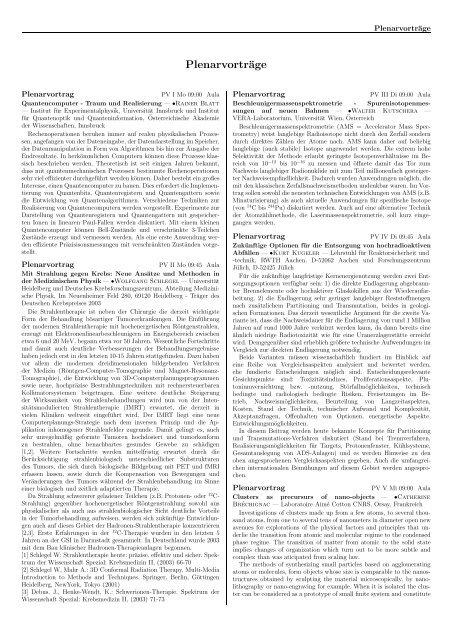

Plenarvortrage Dpg Tagungen

History Of Mathematics Matematik Ba La Ma Mimar Sinan Ga Zel

Seismic And Wind Design Of Concrete Buildings Pdf Normal Mode Civil Engineering

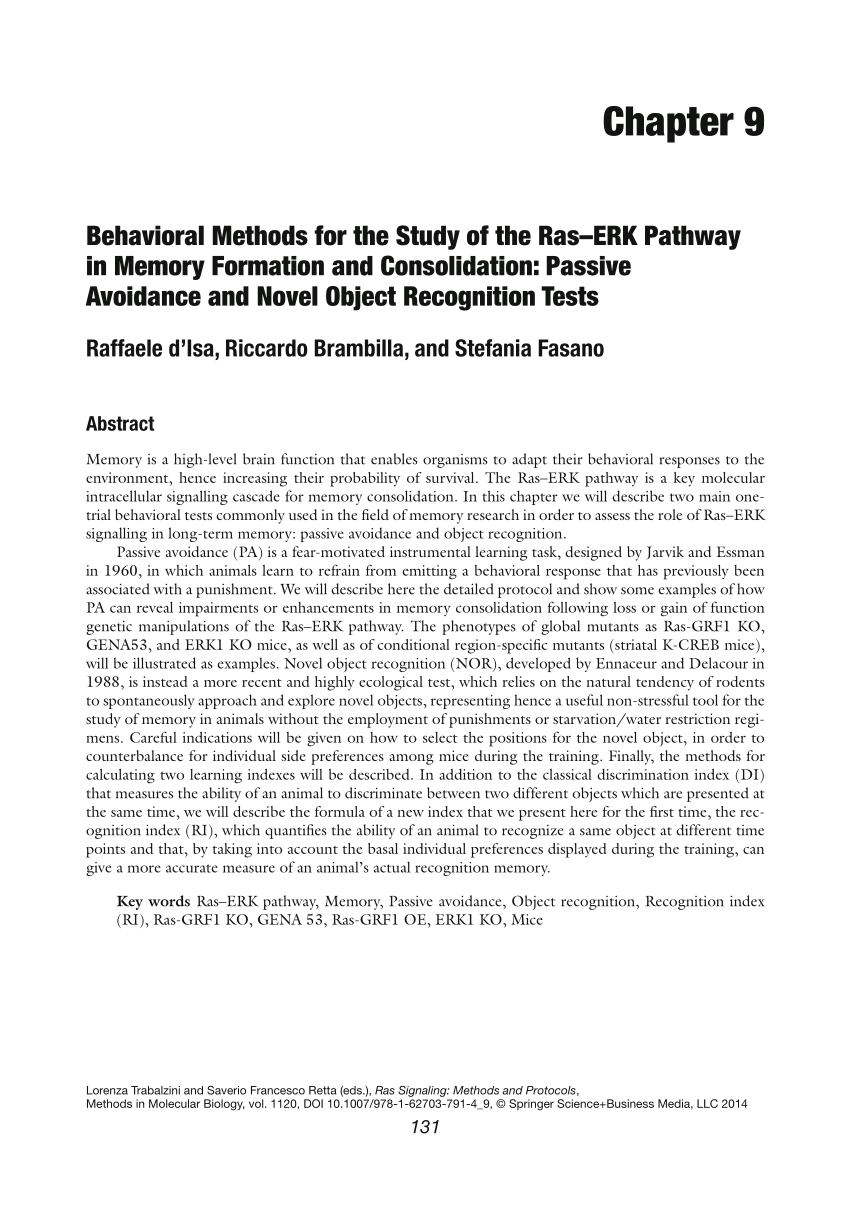

Pdf Behavioral Methods For The Study Of The Ras Erk Pathway In Memory Formation And Consolidation Passive Avoidance And Novel Object Recognition Tests

Pdf The Mother In Attachment Theory And Attachment Informed Psychotherapy

Molecular Cavity For Catalysis And Formation Of Metal Nanoparticles For Use In Catalysis Chemical Reviews

Pdf Ningaloo Collaboration Cluster Socio Economics Of Tourism

Isae 3000 Ici Pakistan Sustainability Report 2019 2020 Pdf Sustainability Corporate Social Responsibility

Pdf Tinnitus And Attention Training Kj Wise Academia Edu

Aktualisiertes Pdf Dpg Tagungen